Regular Savings

Your money. Your Credit Union.

We're here today for your tomorrow.

It only takes $1 to control a stake in the Credit Union and take a step towards reaching your goals.

The Credit Union will make the $1 deposit in the Regular Savings account required to open a membership for you.

Savings at a glance:

- The $1 minimum balance is your share of ownership in the Credit Union. We’ll cover this for you!

- There are no monthly maintenance fees.

- Enjoy the flexibility to open multiple savings accounts to track different spending/saving categories.

- Earn interest.

- Make up to 6 withdrawals1 each month without penalty.

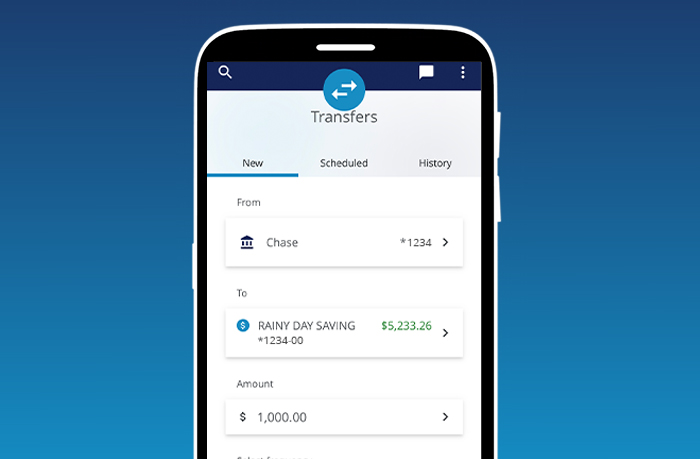

These Rainy Days make savings grow faster.

Open a Rainy Day Savings™ account and earn up to 1.90% APY*.

-

Disclosure

Regular Savings

1The dividend rate and annual percentage yield (APY) may change at any time. Dividends are calculated by the daily balance method which applies a daily periodic rate to the balance in the account each day. The dividend period for this account is monthly. Dividends will begin to accrue on the business day non-cash items are placed (for example checks) into the account. During any statement cycle, no more than six withdrawals or transfers to another credit union account or to a third party by means of a preauthorized, automatic, or computer transfer or telephonic order or instruction. Exceeding the withdrawal limit will result in a $3 fee for each additional transaction and the account may be subject to closure by the credit union.

Open an Account:

Current Members